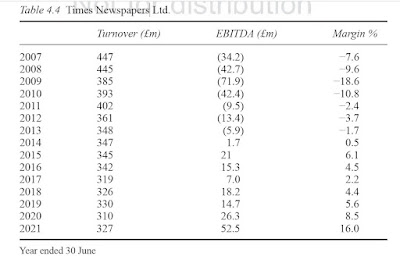

The Times of London filed its annual financials with Companies House yesterday, and they showed that profits of the iconic UK title rose sharply in 2022 for the fourth consecutive year, to £82.9 million. That's up from £52.5 million in 2021, which was up from £26.3 million in 2020, which was up from £14.7 million in 2019. Talk about trending upwards. What a contrast to the years of losses piled up by the Times and its sister Sunday Times before owner Rupert Murdoch ordered a hard paywall erected around their online content in 2010.

The kicker to the story, with which I ended Chapter 1 of my book, is that despite the online success of its Times Newspapers division during the pandemic, parent company News UK cheekily applied to be released from Murdoch's 1981 pledge to keep the Times and Sunday Times separate to preserve what little diversity of press ownership then remained. “The direct and indirect costs of maintaining the undertakings in the current circumstances risks adversely impacting the quality of journalism at The Times and The Sunday Times and, ultimately, the economic viability of the two titles,” it pleaded. It noted the declining print circulation and advertising revenue of its Times papers but made no mention of their growing online revenues. The Covid-19 crisis, it claimed, had put publisher costs "under further and unprecedented pressure, which is unlikely to abate in the short to medium term." The government agreed that there had been a "material change of circumstances" in the newspaper industry and lifted the restrictions after a consultation brought no objections. The irony is that 42 years on, diversity of press ownership is now almost non-existent in the UK, with just three companies controlling 90 percent of the national newspaper market, up from 83 percent in 2019. News UK alone controls 32.1 percent.

Since my book went to press, yet another academic study has confirmed my research findings, this time in Spain. That's on top of studies in Belgium and Switzerland. Where I live in Canada, however, it is quite a different story with the country's largest newspaper chain teetering on the edge of bankruptcy for a second time despite a series of government bailouts since 2018, the largest of which amounted to $595 million but expires this year. Postmedia Network publishes 15 of the country's 21 largest dailies, but is 98-percent owned by U.S. hedge funds which have been squeezing it for every last drop of profit just to pay the crushing loans they also hold. Its revenues have dwindled to the point where they are now dwarfed by the chain's debt payments, so it has been forced to close titles, make mass layoffs, and even sell off some of its buildings.

The country's leading daily, however, is forecasting a $30 million increase in its revenues for 2023. “While others cut back on print, we decided it was a good time to invest,” Globe and Mail publisher Philip Crawley told the World Association of News Publishers last year. “It does make a difference. Readers notice. As do advertisers.” While once 70 percent of its revenue came from advertising, Crawley added, the Globe and Mail was projecting that this year 62 percent would come from subscribers. Print still contributed “significant profitability,” however, with Crawley revealing that print advertising revenue rose by 8 percent in 2021 while its print subscription revenue grew by 1 percent, helping its print paper to an 18-percent profit margin. “We’re confident people will pay for access to good quality, trustworthy content,” he said.

Canada's newspaper publishers are hoping that the government will soon pass the Online News Act, for which they have been lobbying shamelessly. It would force Google and Facebook to share a portion of their revenues with them for supposedly "stealing" newspaper content, similar to legislation passed in Australia in 2021. The digital giants have made it clear, however, that they will stop carrying links to Canadian news stories rather than be used as a piggy bank by the country's media. While that could force the government to choose between bailing out the country's press yet again or letting the owner of most of its largest dailies go out of business, some Canadians are starting to think that the latter alternative might not be such a bad idea after all.

No comments:

Post a Comment